Upward mobility takes a hit due to house-price inflation

Inflated housing prices are deflating the section-8 housing pool for low-income residents

February 3, 2023

We see two families: The first one wealthy and enjoying the saccharine fruits of the stock market, and the second one poor and hoping for a better future. Both of these families aspire to provide a good life for their children. Still, one is put at a severe disadvantage as economic stability dictates development, which is further affected by the lasting impacts of the COVID-19 virus.

In order to understand the root of the issue, it is important to first understand the concept of upward mobility. Upward mobility is when younger generations of a family earn more than their parents when they grow up, putting their family in a better socioeconomic position. The main attribute for this is the location where a kid spends their adolescent years.

In a National Public Radio interview, Harvard economics professor Raj Cheety said, “Take a family that moved from Oakland to San Francisco with, say, a 9-year-old and a 13-year-old. We find the 9-year-old does better than her 13-year-old brother or sister in proportion to that four years of additional exposure to the schools and the environment in San Francisco.”

Children who grow up in better neighborhoods and areas usually earn more than their parents, helping them enter higher income brackets. Seeing this correlation, the US Department of Housing and Urban Development (HUD) introduced the Section 8 housing vouchers program in 1937, which let low-income families move into better neighborhoods for the benefit of their youth.

Families that are part of this program pay 30% of their adjusted income toward rent and utilities while the rest is covered by the government. Adjusted income is defined by the household gross income minus deductions and expenses for children, students, disabled persons, the elderly and medical expenses.

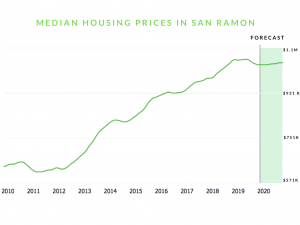

However, COVID-19 has currently made these vouchers hard to implement. Even though the magnitude of the virus has severely been reduced, its impacts on the housing market still persist. The median San Ramon house price in May 2020 was $1,003,000 compared to May 2022 when the median house price shot up to $1,951,000 (Redfin). Hence, landlords are less likely to want to go with government backed tenants, since landlords could get a higher price from an other outside party.

According to Realtor.com, the national median rent is up 12.3% from last July, hitting a record high of $1,879 a month. This in return lowers upward mobility.

This is problematic because it makes it close to impossible for people with a lower pay or those who fall under the poor-middle class bracket to find a place to live, much less in a stable neighborhood and school district.

However, with rising house and rent prices, even government help is not enough for low-income families to be able to afford to move to better communities.

Policy Director Jeffrey Levin from the East Bay Housing Organization (EBHO) further discusses the disparities in the Bay Area housing market. He states that “In the Bay Area, which has been an expensive housing market for as long as anybody can remember, there has always been a housing crisis for low income people. If you make less than $50,000 a year, finding a place you can afford is pretty much impossible unless you have public housing, Section 8 or some other kinds of affordable housing.”

This is where Section 8 Housing Voucher program comes in, allowing low-income families to move into more affluent communities with better schools and safer, better environments that would otherwise be unaffordable However, this program has not been working.

Levin explained, “The housing authorities report on the success rate for Section 8 voucher holders. When it’s good, you’re up in the 80-90% range. When it’s bad, it might be less than 50%. There are some laws that are supposed to protect against discriminating against people because they have Section 8, but it’s still pretty common to find landlords who just don’t want to participate in the program and won’t accept Section 8. Because of all these obstacles, and also because of how much rent the Section 8 program will pay, they’re governed by fair market rents. In a lot of places, you can’t find an apartment that rents or fair market rents and that makes it even harder to use the voucher.”

In hopes to respond to the severe inaccessibility of housing for low income families, the Biden administration has included $25 billion in their fiscal plan for Section 8 housing.

As the prices of rent and housing are soaring due to the pandemic, the Section 8 Housing Vouchers program has become more crucial than ever, but it isn’t a means to an end as high prices mean less people have the opportunity to partake in this program.