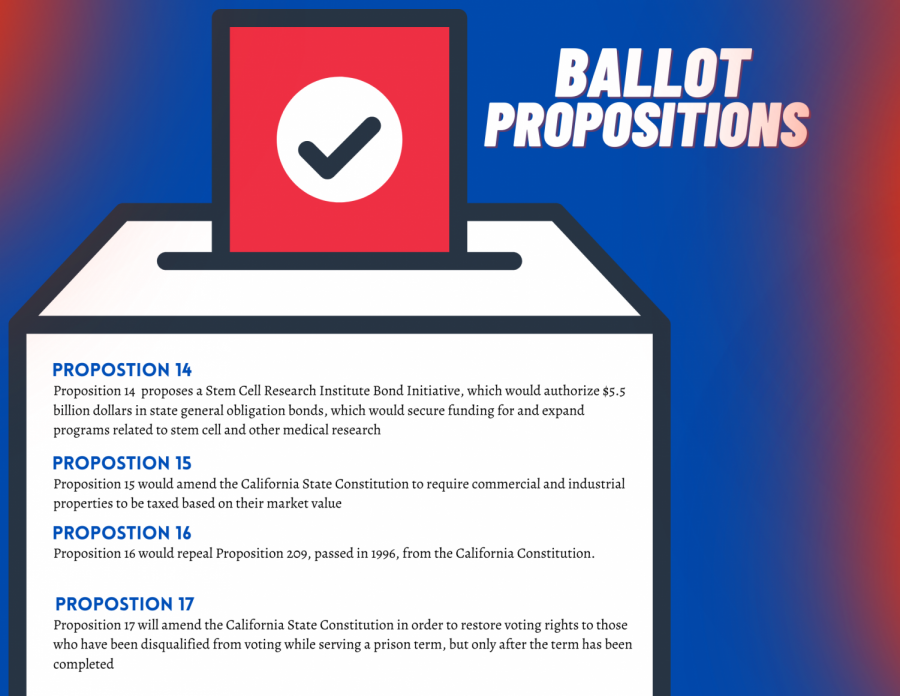

Tribune handy guide to ballot propositions

October 30, 2020

What are ballot propositions?

Ballot propositions, also known as ballot measures, are laws, issues or questions that appear on a state or local ballot. In order to change a state constitution, a ballot measure, proposed by either citizens or legislators, is required in 49 states. According to Ballotpedia.org, “there have been statewide ballot measures in each of the 50 states. Citizens can collect signatures to place laws on the ballot in 26 states.” There are several different types of ballot measures. One is citizen-initiated ballot measures, where citizens can propose ballot measures, in 26 states. Another is legislatively referred ballot measures, where the respective legislative bodies of a state have the power to refer measures to the ballot. Additionally, certain state commissions have the power to refer measures to the ballot.

Currently, 12 ballot measures have been approved to appear on the ballot for the Nov. 3 2020 election. Read more about them below.

Proposition 14

Proposition 14 proposes a Stem Cell Research Institute Bond Initiative, which would authorize $5.5 billion dollars in state general obligation bonds, which would secure funding for and expand programs related to stem cell and other medical research. This includes training, stem cell therapy development and delivery and construction of research facilities. It will also dedicate $1.5 billion dollars to therapy and research for stroke, epilepsy, Alzheimer’s, Parkinson’s and other diseases and conditions that affect the brain and central nervous system. General fund money will be appropriated to pay bond debt service. The side in favor of Prop. 14 argues that this funding is vital to continue research on diseases that affect nearly half of all Californian families. The side against Prop. 14 argues that $3 billion dollars was already granted in 2004, and now that backers want more money, it lacks accountability. They argue that there are more reliable causes for tax money to go to.

Proposition 15

Proposition 15 would amend the California State Constitution to require commercial and industrial properties (minus those zoned as commercial agriculture) to be taxed based on their market value. The money would then increase funding for K-12 public schools, community colleges and local governments. Its fiscal impact is estimated to be $6.5to $11.5 billion in new fundings. Any additional educational funding will supplement existing school funding guarantees. Small businesses are exempt from personal property tax, along with agricultural land and owners of commercial and industrial properties with a combined value of $3 million or less. The side in favor of Prop. 15 argues that not only is more money needed for education, especially given the current pandemic and for areas with students of color, but it’s badly needed to close the commercial property tax loophole in the Bay Area. The side against Prop. 15 argues that California is already expensive, with a toxic climate for business and job creation, and a split-roll property tax will just increase pressure on many businesses.

Proposition 16

Proposition 16 would repeal Proposition 209, passed in 1996, from the California Constitution. Proposition 209 states that “discrimination and preferential treatment are prohibited in public employment, public education, and public contracting on account of a person’s or group’s race, sex, color, ethnicity, or national origin.” In other words, Prop. 209 bans the use of affirmative action based on race or sex. Without Prop 209, state and local governments, public universities and other political subdivisions and entities would be allowed to develop and/or use affirmative action programs. Within the limits of federal law, these programs would grant preferences based on race, sex, color, ethnicity and national origin in public employment, education and contracting. There is no known fiscal impact as of now. The side in favor of Prop. 16 argues that the playing field for people and women of color is drastically imbalanced because of structural inequalities, and the only way to make progress towards changing it is to implement Prop. 16. The side against Prop. 16 argues that it’s a form of discrimination itself to enable affirmative action policies and that systemic inequalities don’t exist.

Proposition 17

Proposition 17 will amend the California State Constitution in order to restore voting rights to those who have been disqualified from voting while serving a prison term, but only after the term has been completed. The side in favor of Prop. 17 argues that once a person’s prison sentence has been completed, they should be encouraged to reenter society, and when people feel like a valuable and heard member of society, they are less likely to return to jail. The side against Prop. 17 highlights the danger of letting criminals vote in elections before they’ve completed parole.

Proposition 18

Proposition 18 falls under the category of suffrage, which refers to ballot measures regarding voting rights. It will allow 17-year-olds who will turn 18 by the next general election to vote in primaries and special elections. The side in favor of Prop. 18, which mostly includes Democrats, believes that allowing these specific 17-year-olds to vote will be able to enhance their civics education, as they will be able to vote while the information is still fresh in their heads. It will also serve to guide them in future elections. However, the opposing side, mostly comprised of Republicans, argue that 17-year-olds could be influenced by their teachers to vote for someone who they might not support on their own.

Proposition 19

Proposition 19 will allow homeowners over the age of 55, severely disabled or whose homes were destroyed by the wildfires or any other natural disaster to transfer their primary residence’s base property tax value to get a replacement residence anywhere in the state. It also expands tax benefits for family farm transfers, limits tax benefits for property transfers between family members and allocates all state revenues and any savings to fire protection services and for local governments for tax-related changes. The side in favor of Prop. 19 argues that it will protect family farms and homes, close tax loopholes and will provide housing relief. The side against Prop. 19 argues that it will cause a billion-dollar tax increase and rid parents of the ability to pass on homes to their children without an increase in property taxes.

Proposition 20

Proposition 20 will close the loopholes within the law that help child molesters, sexual predators and other convicted criminals be released from prison early. Although California already has harsh punishments such as longer prison sentences, there have been many times where crimes have been frivolously passed by. The side in favor of Proposition 20 has claimed that this proposition will be able to fix the consequences created by Prop. 47 and 57, where inappropriate crimes such as kidnapping a child to sell them as a sex slave were considered to be “non-violent”. However, the side opposing Prop. 20 claims that it wastes millions of dollars and rolls back progress on changing the criminal justice system and wasteful prison spending.

Proposition 21

Proposition 21 will amend the state law to let local governments establish rent control on residential properties that are over 15 years old and establish local limits on annual rent increases, which can be different from the statewide limit. This proposition also allows rent increases of up to 15 percent for over three years when a new tenant moves in and prohibits rent control violating a landlord’s right to fair financial return. It also exempts people who have no more than two houses from new rent control policies. The side in favor of Prop. 21 argues that this proposition will help the working class, families and seniors stay housed and will keep taxes low. The side against Prop. 21 argues that it reduces the availability of affordable and middle-class housing, doesn’t allow the public to oversee new rent policies and eliminates homeowner protections.

Proposition 22

Proposition 22 seeks to establish drivers for app-based transportation companies as “independent contractors” instead of employees. Those who are in favor of Prop 22. believe in the ability for app-based drivers to exist as “independent contractors” and be able to control the flexibility of their own schedule, supporting those who use these apps as their supplemental income and have other jobs as their supplemental income. Those who are against Prop 22. point out that its consideration of drivers as “independent contractors” lets companies such as Uber, Doordash and Lyft get away with creating special exemptions that eliminate basic workplace benefits and replaces them with a new lower “earnings guarantee” and “healthcare subsidy” payments designed to save the companies money.

Proposition 23

Proposition 23 established requirements for kidney dialysis clinics. It requires at least one on-site licensed physician during treatments in kidney dialysis clinics. The side in favor of Proposition 23 claims that it will help patients have easier access to physicians whenever dialysis treatments are being provided and promotes proper reporting and transparency, which can improve the quality of clinics. Additionally, the supporters of Prop. 23 think that stronger protections need to be provided for vulnerable patients when clinics close. However, the side opposing Proposition 23 claims that it would force clinics to set service and closing dates which can put lives at risk. Additionally, it would increase overcrowding in emergency rooms and the physician shortage would worsen.

Proposition 24

Proposition 24 falls under the category of business, and will expand the facilities and services of the California Consumer Privacy Act (CCPA) and create the California Privacy Protection Agency to implement and enforce the CCPA. Supporters believe that the existing privacy protection laws aren’t strong enough, while the new proposition would because it would triple the fines on companies that violate kids’ privacy. The opposers believe that California’s data privacy laws are very new and need more time to come into full effect. They believe that Prop. 24 would hurt consumers more than benefiting them. They also point out that it lacks support from a wide range of privacy advocates.

Proposition 25

Proposition 25 poses a referendum on the law that will replace the money bail system with a system based on public safety and flight risk. Those who agree with Prop. 25 claim that the current money bail system is gross economic injustice. It allows those who can pay to go free until their trial. However, if they can’t afford bail, they must stay in jail. The system often benefits the rich, allowing them to go free, even when accused of serious violent crimes, while the poor stay in jail even when innocent or accused of low-level, nonviolent offenses. Those who oppose Prop. 25 state that money bail is an important constitutional right and ensures defendants satisfy the terms of their jail release, appear for trial and are held accountable if they don’t. They also point out that Prop. 25 will cost local governments and California hundreds of millions of dollars, as cities and counties face historic budget deficits and devastating cuts to essential services.