The San Ramon Valley Unified School District (SRVUSD) is currently facing a significant funding challenge as its existing local parcel tax, which generates $6.8 million annually, is set to expire in 2025. This parcel tax has been crucial in supporting 56 teaching positions and funding various academic programs within the district. Alongside the parcel tax, the district anticipates the expiration of $6 million in one-time state funding over the next two years which was allocated for specific programs and initiatives such as the free lunch program. These financial changes put pressure on SRVUSD’s ability to maintain essential programs, hire specialized teachers, and ensure students’ academic success.

Despite receiving one-time state funding, SRVUSD faces challenges in covering the costs of its diverse range of extracurricular activities and academic programs which play crucial roles in contributing to a students’ success and support received from the district. While the state funds the district receives provide valuable support, they are often insufficient to maintain the quality of initiatives that have become integral to the district’s educational excellence. This underscores the critical role the local parcel tax plays in filling the financial gaps for the Department of Education. Without the renewal of parcel tax, the district stands to lose critical funding deemed necessary to maintain academic and extracurricular prowess and support teacher salaries.

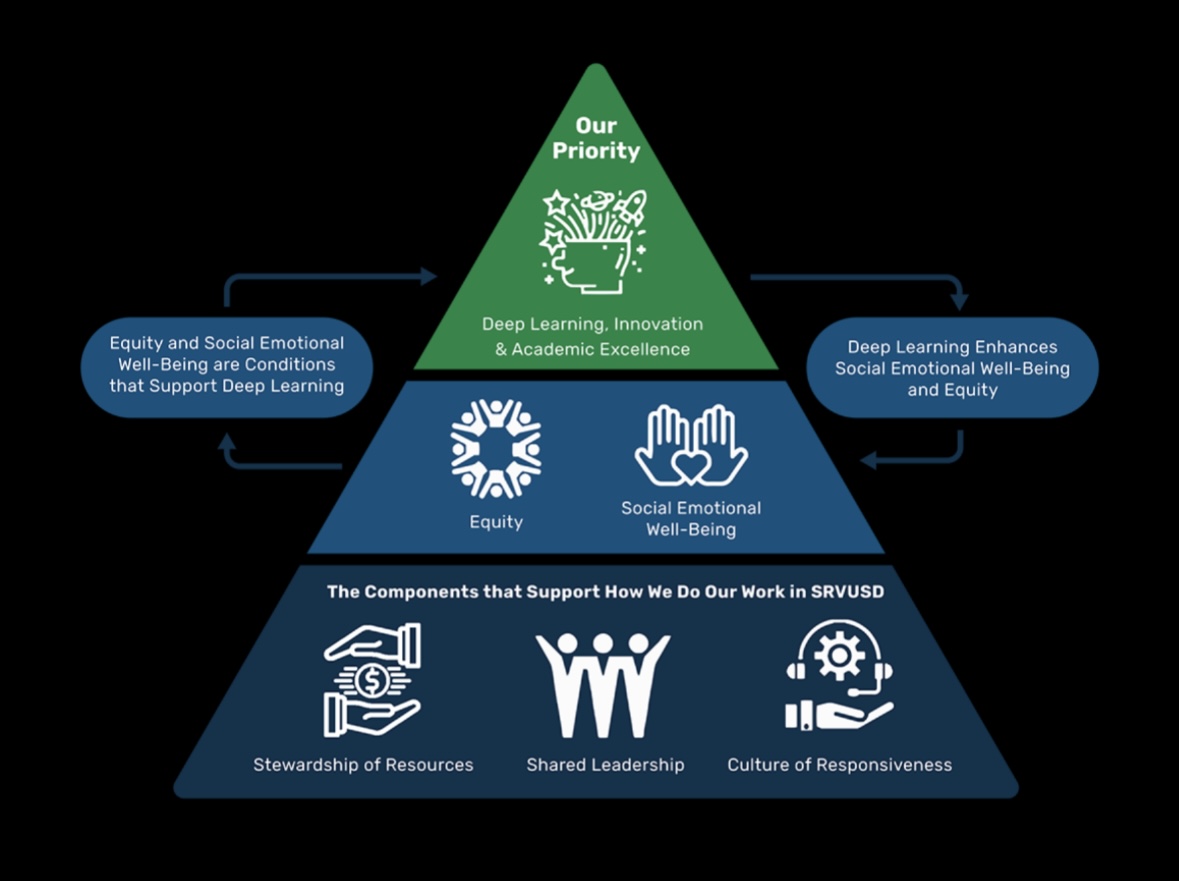

The parcel tax supports a wide array of academic programs that have become the backbone of SRVUSD’s educational framework. These programs span an extensive spectrum, from nurturing reading and literacy skills among young learners to extending a helping hand to students facing academic challenges. Crucially, the tax has been instrumental in addressing pressing student mental health concerns, underscoring its role in supporting emotional well-being within the educational context. The potential loss of this tax would significantly impact not only these crucial programs but also students with other unique needs

Beyond academics, the parcel tax aids in attracting and retaining highly qualified educators who can cater to students with unique requirements. These specialized educators often play a crucial role in shaping the educational experience of students who need tailored approaches. This funding source plays a pivotal role in enabling the district to offer competitive salaries to educators. This financial support is necessary for retaining highly qualified teachers who contribute to the district’s reputation for academic excellence. It allows teachers the opportunity to live in the surrounding areas, providing them with a reasonable quality of life and proximity to their workplaces. This increases the accessibility of teachers to students and strengthens the overall educational environment.

The tax has a broader impact on the community by contributing to the stability of local property values. High quality public schools are often a significant factor in property values within neighborhoods. Thus, the renewal of the parcel tax holds importance for homeowners and the wider community.

Renewing the parcel tax is a collective effort that relies on community involvement and active participation in the democratic process. To secure the continuation of this critical funding source, community members have the opportunity to vote and voice their opinions. The process typically involves organizing a local election or ballot measure, where eligible voters within the school district can cast their ballots to decide the fate of the tax renewal. Importantly, this process requires a two-thirds majority vote to pass, underlining the significance of widespread support.

As the parcel tax approaches its expiration, SRVUSD is seeking its renewal, emphasizing transparency and efficiency in fund utilization. Accountability mechanisms, such as citizen oversight, annual audits, and public reporting, will ensure that the funds are managed carefully. The renewal is not a new tax but an extension of the existing parcel tax as a supplemental that would replace it. This ensures that vital funding for public schools is maintained without imposing additional financial burdens on the community.

Community support plays a decisive role in securing the renewal of the parcel tax. This tax sustains counseling and wellness resources, extracurricular activities, and holistic education for students.

Laura Bratt, an SRVUSD Board Member, highlights the importance of the parcel tax, stating, “Our school district is very poorly funded for the level of that our students perform. The tax provides us with adequate funding for sports and various extracurriculars that students are involved with.”

The renewal of the parcel tax is a pivotal decision for SRVUSD and its community. Its impact extends beyond financial figures; it influences the quality of education, the support for students, and the overall well-being of the district. As SRVUSD navigates these financial challenges, the community’s support will be instrumental in shaping the future of the district’s educational offerings. The forthcoming vote determining the future of SRVUSD’s funding holds the key to sustaining the excellence that SRVUSD is known for. It is a decision that will directly impact students, teachers, and the entire community, highlighting the importance of community engagement in securing a brighter future for education.